We are an industrial holding company, which means we leverage the power of industry partners to ensure that our group companies develop sustainably for the long term. These partners are seasoned managers who contribute their passion, top-notch networks and exceptional technical expertise. We are pleased to introduce the industry partners who are part of our team.

What do you find motivating about working at E3?

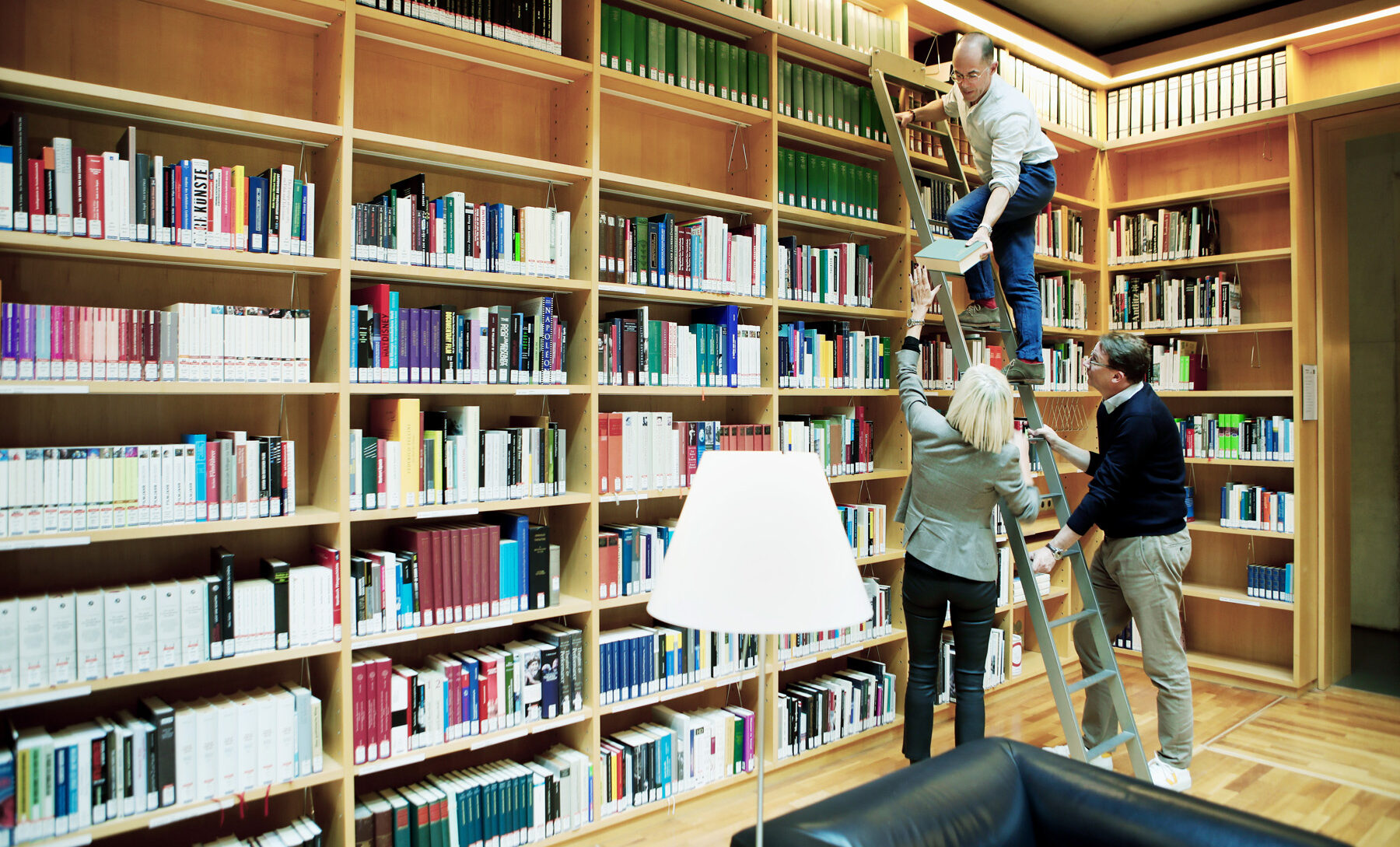

Ralf Koschitzki: “I am used to thinking ahead, initiating and changing things. And I am passionate about pushing high-potential ideas at the earliest stage possible. Being a strategic development and transformation manager, the advisor role means a change of perspective for me personally – in addition to my previous management and consulting responsibilities, it is now about the big picture of value development. Promising investments with high sustainability potential are identified, brought on board and developed together with E3’s investment experts. This is the closest I come to the role of the entrepreneur. I also find E3’s strategic investment approach of building an industrial conglomerate with a great deal of expertise and striving for excellence to be much more sustainable than the traditional, soulless private equity approach of buying opportunities, developing them and then selling them. The idea of a sustainable group gives a different sense of purpose to one’s own actions – above and beyond the pure pursuit of profitability. I am happy to contribute my experience and my network here.

If you combine the conglomerate approach with sustainable future trends such as ESG, then something truly “new” – even unique – can emerge. It’s no longer only about how we do something. Rather, the central question is who we want to be and what standards we set for ourselves. E3 is one of the first to even ask these questions, which makes it a perfect match for my enthusiasm for being an early mover.”

Is there an ESG initiative that you find inspiring?

Ralf Koschitzki: “I am quite familiar with ESG topics from a variety of different perspectives. I think it is crucial that we stop talking and starting acting. All of the 17 SDGs are relevant and create value. But I want to highlight one aspect that, in my opinion, is still underestimated: the availability of clean drinking water. This is not just about availability in developing countries. Water will become an issue in industrialised countries in particular and especially in connection with the availability and production of agricultural and food products.

Water is a hidden resource. Who would think that it takes an average of 15,400 litres of water to produce one kilogramme of beef? (For one kilogramme of pork and poultry we are talking about around 6,000 litres and 4,300 litres, respectively. By comparison, around 2,300 litres of water are needed to produce one kilogramme of whole grain rice, which Europeans today also consume in large quantities. And one kilogramme of wheat requires around 1,400 litres of water on average worldwide.) As these quantities of water are directly linked to our lifestyle, we need to ask ourselves one question: how can we use this scarce resource more effectively in future? Especially when our climate changes and rainfall is no longer sufficient to fill groundwater reservoirs. Climate-related changes will force us to approach things differently here.”

What does “sustainable investing” mean to you?

Ralf Koschitzki: “The term “sustainability” in the context of investments is ambiguous. In short, for me:

Sustainable investment = an investment with a continuous, promising profitability + value added to society.

Ideally, a fixed percentage of profitability is intentionally invested in social value development. It is important that this is not about sending out marketing messages, but about real economic value contribution. It is preferable to make slow continuous progress, if that means it is more real and tangible.”

Share article